Children Education Allowance related recommendations of 7th Pay Commission – Basic CEA has been recommended to be increased 1.5 times

CEA is paid to government employees to take care of schooling and hostel requirements of their children. The rates of CEA are double for a differently abled child.

Many demands have been received regarding CEA. It has been requested that the amount be suitably raised and CEA should be extended for Graduation/Post Graduation level studies also. The Commission has received an overwhelming number of requests for simplification of the procedure for reimbursement.

Analysis and Recommendations

8.17.13 Before VI CPC recommendations, the scheme was known asChildren Education

Assistance and provided at the following rates:

| Component | Class I- | Class XI-XII | Requirement |

| Reimbursement of Tuition | 40 | 50 | – |

| Reimbursement of Tuition Fee for Disabled and mentally retarded children (₹ pm) | 100 | 100 | – |

| Children Education | 100 | 100 | In case the government employee is compelled to send his child to a school away from the Station of his posting |

| Hostel Subsidy (₹pm) | 300 | 300 | In case the employee is obliged to keep his children in a hostel away from the Station of his posting and residence on account of transfer. |

The VI CPC rationalized the structure to the following:

| Component | Present Rates | Remarks |

| CEA | ₹1500 pm | Whenever DA increases by 50% CEA shall increase by 25% |

| Hostel Subsidy | ₹4500 pm | Whenever DA increases by 50% Hostel |

Effectively a 10-fold rise was given by VI CPC. This has led to high expectations, and consequently, vast number of demands for increasing the rates, expansion of scope and simplification for procedure ofreimbursement of this allowance.

The various issues are examined seriatim:

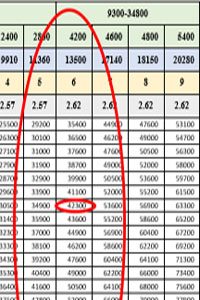

Has CEA kept pace with time? Presently CEA goes up by 25 percent each time DA increases by 50 percent. Thus, since DA currently stands at 113 percent, CEA has gone up by 50 percent from its 2008 level. As against this, the movement of the All India Education Index33 is shown below:

The above chart shows that between 2008 and 2013, the Education Index has gone up from 134 to 154, i.e., by 14.9 percent, whereas CEA went up by 25 percent w.e.f.

01.01.2011 (when DA exceeded 50 percent). Thus, it can be concluded that increase in CEA has kept pace with (and in fact exceeded) the cost of education.

What is the adequate level of compensation?

Given the wide range of educational institutions, and the varying fee structure, the question of adequacy depends upon many factors. On the one hand we have government institutions like Kendriya Vidyalayas that charge fees to the tune of ₹1,000 per month (including Vidyalaya Vikas Nidhi) and on the other hand there are private institutions where the monthly fee varies from ₹5,000 to ₹25,000 (or even more) per month.

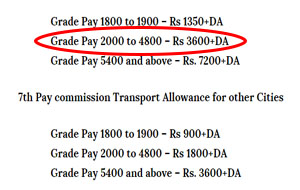

On the whole, the Commission is of the view that quantum of CEA should be calibrated in such a manner that the main objective is met without the government entering into the field of subsidizing private education. Hence, taking into account the various items of expenditure that are reimbursed as a part of this allowance, the following is recommended:

| Component | Recommended rate | Remarks |

| CEA (₹ pm) | 1500×1.5 = 2250 | Whenever DA increases by 50%, CEA shall increase by 25% |

| Hostel Subsidy (₹ pm) | 4500 x 1.5 = 6750 (ceiling) | Whenever DA increases by 50%, Hostel |

The allowance will continue to be double for differently abled children.

What should be the scope of CEA?

Presently CEA is payable up to Class XII. There is a strong demand for increasing the scope to Graduate and Post Graduate studies. However, due to the greatly varying nature of studies at the graduate level and beyond,the extension of scope of the allowance beyond Class XII cannot be accepted.

( hari krishnamurthy K. HARIHARAN)"

( hari krishnamurthy K. HARIHARAN)"'' When people hurt you Over and Over think of them as Sand paper.They Scratch & hurt you, but in the end you are polished and they are finished. ''"Keep away from people who try to belittle your ambitions. Small people always do that, but the really great ones make you feel that you too, can become great."- Mark Twain.யாம் பெற்ற இன்பம் பெருக வையகம்